In today’s digital age, owning a camera is a common practice for capturing precious moments and creating lasting memories. However, with the rise in technology, digital cameras have become more expensive and fragile, making them susceptible to damage or theft. This raises the question: how much does it cost to insure a digital camera?

Camera insurance is a smart investment for photographers and enthusiasts alike, providing peace of mind and financial protection in case of accidents or unforeseen circumstances. The cost of insuring a digital camera can vary depending on factors such as the camera’s value, brand, and the coverage you choose.

Whether you’re a professional photographer or a casual hobbyist, having camera insurance can save you from costly repairs or replacements. By exploring your options and comparing quotes from different insurance providers, you can find a policy that fits your budget and offers comprehensive coverage for your digital camera.

Factors Affecting Digital Camera Insurance Costs

When considering the cost of insuring a digital camera, there are several factors that can impact the price of your insurance policy. Here are some key factors to keep in mind:

| Camera Value | The value of your digital camera will directly impact the cost of insurance. Higher-value cameras will generally have higher insurance premiums. |

| Camera Model | Some camera models are more prone to theft or damage, which can affect insurance costs. High-end or popular models may have higher premiums. |

| Deductible | The deductible is the amount you pay out of pocket before your insurance coverage kicks in. Choosing a higher deductible can lower your premium but may result in higher out-of-pocket costs in the event of a claim. |

| Location | Where you live can also impact insurance costs. If you live in an area with higher rates of theft or property damage, your insurance premiums may be higher. |

| Usage | How you use your digital camera can affect insurance costs. If you use your camera professionally or take it on trips frequently, you may need additional coverage, which can increase premiums. |

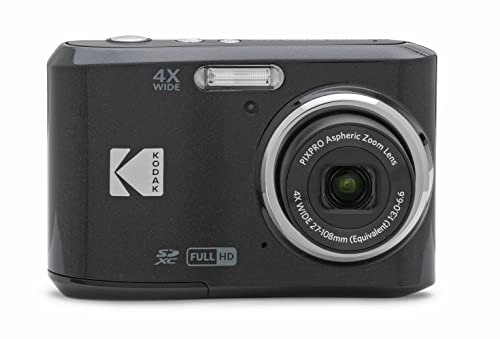

Camera Model and Brand

When it comes to insuring a digital camera, the model and brand play a significant role in determining the cost of insurance. High-end models from popular brands such as Canon, Nikon, Sony, and Fujifilm may require higher premiums due to their expensive replacement costs. On the other hand, entry-level models from lesser-known brands may have lower insurance premiums.

It’s important to provide detailed information about your camera model and brand when seeking insurance quotes to ensure accurate coverage and pricing.

Policy Coverage Options

When insuring your digital camera, it’s important to consider the coverage options available to you. Here are some common policy coverage options:

- Accidental Damage: This coverage protects your camera in case it is accidentally dropped or damaged.

- Theft: This coverage provides protection in case your camera is stolen.

- Loss: Some policies offer coverage in case your camera is lost or goes missing.

- Water Damage: This coverage protects your camera from damage caused by water or other liquids.

- Extended Warranty: Some policies offer extended warranty coverage beyond the manufacturer’s warranty period.

It’s important to carefully review the coverage options and choose a policy that best suits your needs and budget.

Insurance Company Reputation

When looking for insurance for your digital camera, it is crucial to consider the reputation of the insurance company. A reputable insurance company will have a track record of providing reliable and efficient services to their customers. You can research customer reviews and ratings online to get an idea of the company’s reputation.

Additionally, it is important to choose an insurance company that has a good financial standing and a history of fulfilling claims promptly. This will give you peace of mind knowing that your camera will be protected in case of theft, damage, or loss.

Camera Accessories Coverage

When considering insurance for your digital camera, don’t forget about coverage for your camera accessories. Camera accessories such as lenses, tripods, camera bags, and memory cards can add up to a significant investment. Make sure your insurance policy provides coverage for these accessories in case of theft, loss, or damage.

Most insurance providers offer optional coverage for camera accessories, so be sure to inquire about adding this to your policy. It’s important to assess the value of your accessories and determine if the coverage provided is sufficient to protect your investment.

Having camera accessories coverage can give you peace of mind knowing that your entire photography kit is protected in case of unforeseen circumstances. Talk to your insurance provider to ensure you have comprehensive coverage for both your camera and accessories.

Policy Deductible Amount

When considering how much it costs to insure a digital camera, you should also take into account the policy deductible amount. The deductible is the amount of money you will need to pay out of pocket before your insurance coverage kicks in. Typically, the higher the deductible, the lower your insurance premium will be. However, it’s important to carefully consider your financial situation and how much you can afford to pay in the event of a claim.

Before purchasing camera insurance, make sure to review the policy deductible amount and choose a deductible that aligns with your budget and risk tolerance. Keep in mind that a lower deductible may result in a higher premium, while a higher deductible may lower your premium but require you to pay more out of pocket in the event of a claim.

| Deductible Amount | Impact on Premium | Out-of-Pocket Expense |

|---|---|---|

| Low | Higher premium | Lower out-of-pocket expense |

| High | Lower premium | Higher out-of-pocket expense |

Camera Usage Frequency

When determining the cost of insuring a digital camera, one important factor to consider is how frequently you plan to use the camera. Insurance premiums may vary depending on whether you use the camera occasionally for special occasions or events, or if you use it regularly for professional or hobbyist purposes.

Insurance providers often take into account the risk associated with the frequency of camera usage. The more often you use your camera, the higher the likelihood of accidents or damage occurring. Therefore, if you use your camera frequently, you may be required to pay a higher insurance premium to ensure adequate coverage.

Storage Location

When determining the cost to insure your digital camera, the storage location plays a significant role. If you plan to store the camera at home, the insurance premium may be lower compared to storing it in a car or public storage unit. Cameras stored in a home are less likely to be damaged or stolen, resulting in a lower risk for the insurance provider.

Home Storage

If you store your digital camera at home, make sure to provide details about the security measures in place, such as locks, alarms, or safes. This information can help reduce your insurance premium as it demonstrates a lower risk of theft or damage.

Off-Site Storage

If you need to store your camera in a car or public storage unit, be prepared for a potentially higher insurance premium. These locations pose a higher risk for theft or damage, leading to increased insurance costs. Take precautions to secure your camera in these environments to minimize risks.

| Storage Location | Potential Insurance Costs |

|---|---|

| Home | Lower |

| Car or Public Storage Unit | Higher |

Policy Term Length

When purchasing insurance for your digital camera, one important factor to consider is the length of the policy term. Policy term length refers to the duration of time that your insurance coverage will be in effect. Insurance companies typically offer policies with various term lengths, such as one year, two years, or even longer.

It’s important to choose a policy term length that aligns with your needs and usage of the digital camera. For instance, if you plan to use the camera frequently and in high-risk situations, a longer policy term may provide more peace of mind. On the other hand, if you only use the camera occasionally or plan to upgrade to a new model soon, a shorter policy term may be more suitable.

Before selecting a policy term length, make sure to review the coverage details, exclusions, and any additional benefits offered by the insurance provider. By understanding the terms and conditions of the policy, you can ensure that your digital camera is adequately protected for the duration of the chosen term length.

Claim History

When determining the cost to insure a digital camera, insurance companies will often take into account your claim history. If you have made multiple claims in the past, it may result in higher premiums as you are seen as a higher risk customer. On the other hand, if you have a clean claim history with no previous claims, you may be eligible for a lower insurance rate.

It’s important to be honest about your claim history when applying for camera insurance, as providing inaccurate information can lead to your policy being voided or your claims being denied in the future.

| Claim History | Premium Impact |

|---|---|

| Clean history (no previous claims) | Likely to receive lower insurance rates |

| Multiple claims | May result in higher premiums |

Discounts and Promotions

When shopping for camera insurance, be sure to look out for discounts and promotions that may be available. Many insurance providers offer discounts for bundling multiple policies together, such as combining camera insurance with home or auto insurance.

Additionally, some insurance companies may offer promotional discounts for new customers or for signing up online. Be sure to ask about any current promotions or discounts when requesting a quote.

FAQ

How much does it cost to insure a digital camera?

The cost of insuring a digital camera can vary depending on several factors, including the value of the camera, the coverage you choose, and the insurance provider. On average, you can expect to pay anywhere from $20 to $50 per year to insure a digital camera.

What factors can influence the cost of insuring a digital camera?

Several factors can influence the cost of insuring a digital camera, such as the camera’s value, where you live, the level of coverage you choose, your claims history, and the insurance provider you select. Higher-value cameras and more comprehensive coverage options may result in higher insurance premiums.

Is it worth it to insure a digital camera?

Insuring a digital camera can be worth it if you use your camera frequently, travel with it often, or own an expensive model. Camera insurance can provide peace of mind in case of theft, damage, or loss. However, you should weigh the cost of insurance against the potential benefits and consider your individual needs and usage patterns before deciding whether to insure your camera.